Bitcoin: Revolutionizing Currency and Protecting Wealth in Inflationary Times

Is Bitcoin an Inflation Hedge? Protecting Your Wealth in a Chaotic World

Inflation, the relentless monster that erodes the value of our hard-earned money, is on everyone's mind these days. We all feel its bite when we fill up our gas tanks or buy groceries. Prices seem to be skyrocketing, leaving us wondering how to safeguard our wealth in this tumultuous financial landscape. Enter Bitcoin, the digital currency that has garnered significant attention as a potential hedge against inflation. But is it truly the answer we've been searching for?

Let me take you on a journey where we explore the fascinating world of Bitcoin, dissect the concept of inflation, and delve into the relationship between the two. Along the way, we'll uncover the advantages and risks of using Bitcoin as an inflation hedge and compare it to traditional investments like gold and real estate. So sit back, relax, and let's embark on this enlightening adventure together.

Understanding Inflation:

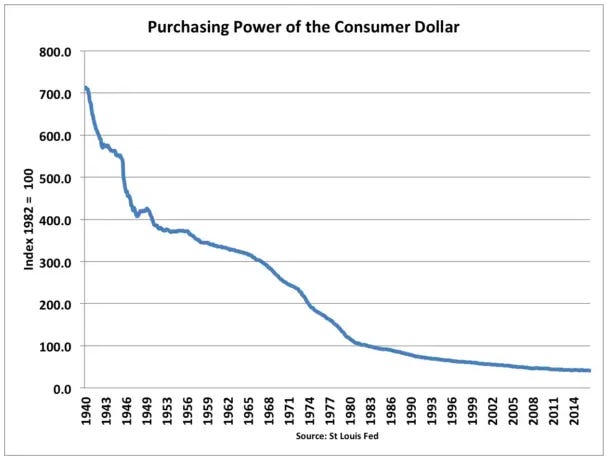

Before we dive into the intricacies of Bitcoin's role as an inflation hedge, let's grasp the essence of inflation itself. Inflation refers to the steady increase in prices over time, resulting in a decline in the purchasing power of a currency. It's like a silent predator, slowly chipping away at the value of our hard-earned money. And lately, it feels more like a roaring beast, devouring our wallets faster than we can replenish them.

But why does inflation happen?

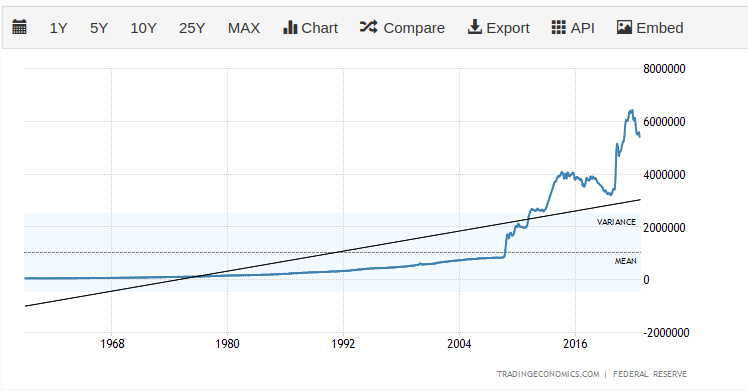

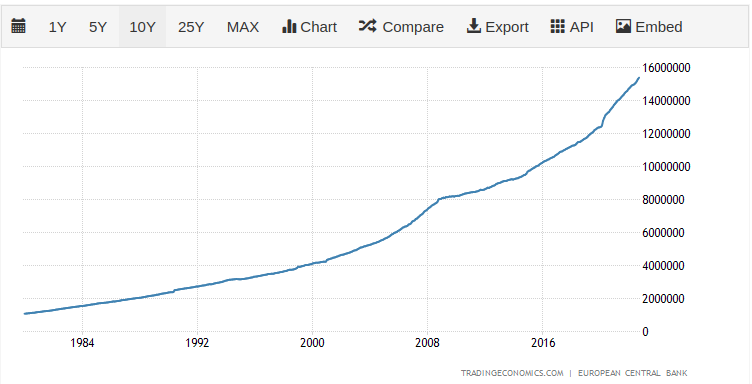

The answer lies in the actions of central banks and their monetary policies. Central banks aim to maintain a stable economy by targeting a certain level of inflation, typically around 2%. However, recent times have witnessed an unprecedented increase in the money supply due to panic-induced measures to sustain the illusion of prosperity during global economic standstills. This excessive money printing leads to a devaluation of the currency, contributing to the inflationary spiral we find ourselves in today.

What is Bitcoin?

Bitcoin, often referred to as a cryptocurrency, is a digital form of money that operates on a technology called blockchain. Unlike traditional fiat currencies, Bitcoin is not controlled or issued by any central authority, such as a government or financial institution. Instead, it relies on a network of computers and cryptography to ensure the integrity and security of transactions.

Properties of Bitcoin:

Decentralization: Bitcoin's decentralized nature is one of its most significant properties. It operates on a global network of computers, known as nodes, which collectively maintain the blockchain ledger. This decentralized structure eliminates the need for a central authority, making Bitcoin resistant to censorship, control, and single points of failure.

Security: Bitcoin employs advanced cryptographic techniques to secure transactions and protect users' funds. Each transaction is verified and recorded on the blockchain, a public and immutable ledger. The use of complex mathematical algorithms ensures the integrity of transactions and prevents fraud or tampering.

Limited Supply: Unlike traditional currencies that can be printed at will, Bitcoin has a limited supply. The total number of Bitcoins that can ever exist is capped at 21 million. This scarcity, combined with increasing demand, has the potential to drive the value of Bitcoin over time.

Privacy: Bitcoin transactions offer a level of privacy and pseudonymity. While the transactions themselves are public and recorded on the blockchain, the identities of the individuals involved are not directly linked to their Bitcoin addresses. However, it's important to note that Bitcoin is not entirely anonymous, as additional measures are required to maintain privacy.

Benefits of Bitcoin:

Financial Freedom: Bitcoin empowers individuals with financial sovereignty. It allows for borderless and permissionless transactions, enabling anyone with an internet connection to send and receive funds globally. This is especially beneficial for individuals in countries with limited access to traditional banking services or facing economic instability.

Lower Transaction Fees: Traditional financial systems often involve substantial fees for transferring money across borders or conducting large transactions. Bitcoin transactions, on the other hand, typically involve lower fees, especially for cross-border transfers. This makes it an attractive option for international commerce and remittances.

Speed and Accessibility: Bitcoin transactions can be processed quickly, especially when compared to traditional banking systems that may take several days for international transfers. Additionally, Bitcoin allows for microtransactions, enabling the exchange of small amounts of value that would be impractical or costly with traditional methods.

Bitcoin as an Inflation Hedge:

Now, let's turn our attention to Bitcoin and its potential as an inflation hedge. It's essential to note that predicting the future is impossible, and there are no guarantees that Bitcoin will thrive in the long run. However, considering its limited supply, with only 21 million coins ever to be mined, its deflationary nature, and the exponential growth of its user base, Bitcoin seems poised to increase in value over time. As the meme goes, "21 million divided by infinity."

But hold on! Before we jump to conclusions, it's crucial to recognize that this is just an opinion, not an indisputable fact. However, if Bitcoin manages to survive and grow, it could become the ultimate inflation hedge and a powerful tool for preserving and transporting wealth.

Additional Benefits of Bitcoin as an Inflation Hedge:

Diversification: Bitcoin offers an alternative investment opportunity to diversify your portfolio. By including Bitcoin alongside traditional assets like stocks, bonds, and real estate, you reduce the risk associated with a single investment class.

Store of Value: Bitcoin's digital nature allows for easy storage and transfer, making it a convenient store of value. You can securely hold and transport your wealth without the need for intermediaries or extensive paperwork.

Financial Security: Bitcoin provides a level of financial security in an era of economic uncertainty. Its decentralized nature and cryptographic protocols make it highly resistant to hacking and fraud, ensuring your wealth remains safe.

Potential for Growth: While Bitcoin's volatility is a topic of concern, its historical performance indicates substantial growth over the years. Despite recent market fluctuations, Bitcoin has maintained a price well above previous levels, showcasing its resilience and potential.

Long-Term Investment: Investing in Bitcoin can be seen as a long-term strategy to preserve and accumulate wealth. By holding a portion of your portfolio in Bitcoin, you can potentially benefit from its long-term growth potential and its ability to act as a hedge against inflation.

Risks and Considerations:

While Bitcoin offers potential advantages as an inflation hedge, it's important to be aware of the risks and considerations associated with investing in it. Here are a few key points to keep in mind:

Volatility: Bitcoin is known for its high volatility, with significant price fluctuations occurring in relatively short periods. This volatility can be both a blessing and a curse. While it presents opportunities for substantial gains, it also carries the risk of significant losses. It's crucial to carefully evaluate your risk tolerance and consider the potential impact of Bitcoin's price volatility on your investment portfolio.

Regulatory Uncertainty: The regulatory environment surrounding cryptocurrencies is still evolving. Changes in regulations or the introduction of new laws could impact the use and acceptance of Bitcoin, potentially affecting its value. Stay informed about the legal and regulatory developments related to Bitcoin in your jurisdiction to make informed investment decisions.

Technological Risks: Bitcoin's underlying technology, blockchain, is relatively new and complex. While it has proven to be secure and resilient, there's always the risk of technical vulnerabilities, hacking attempts, or other unforeseen issues that could impact the value and stability of Bitcoin.

Market Adoption: The widespread adoption of Bitcoin is still a work in progress. While it has gained significant popularity, it is not yet universally accepted as a form of payment or a mainstream investment asset. The level of adoption and acceptance of Bitcoin in the future will play a crucial role in its value proposition as an inflation hedge.

Comparing Bitcoin to Traditional Inflation Hedges:

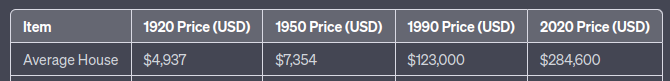

When considering Bitcoin as an inflation hedge, it's essential to compare it to traditional assets commonly used for this purpose. Two notable examples are gold and real estate:

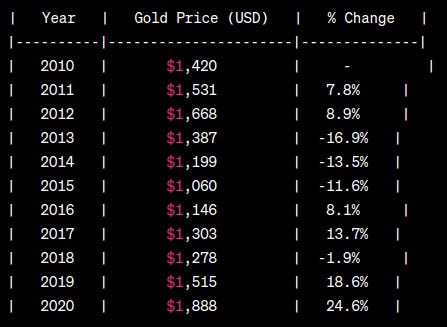

Gold: Gold has been a traditional store of value and hedge against inflation for centuries. It has a long history of maintaining its worth and is widely regarded as a safe haven asset. However, gold has limitations in terms of accessibility and portability compared to Bitcoin. Bitcoin's digital nature allows for easy storage and transfer, providing additional convenience and potential advantages.

Past 20 years (2001-2021): Gold has performed well as an inflation hedge, with an average annual return of approximately 9.0%.

Past 50 years (1971-2021): Gold has shown strong performance as an inflation hedge, with an average annual return of approximately 7.9%.

Past 100 years (1921-2021): Gold has been an effective inflation hedge, providing an average annual return of approximately 4.9%.

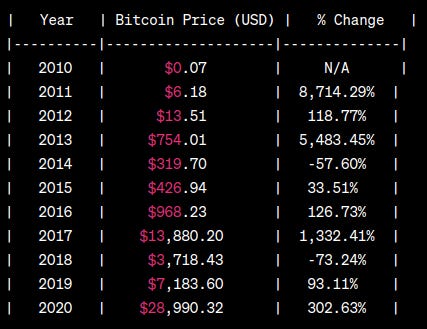

For comparison, here’s the data for price volatility for the years 2010-2020 for Gold and Bitcoin.

Real Estate: Real estate is another commonly used inflation hedge. It offers the potential for capital appreciation and can provide a steady income stream through rental properties. However, real estate investments require significant capital and can be illiquid, limiting flexibility. Bitcoin, on the other hand, offers more accessibility, liquidity, and the potential for higher growth.

Ways to Buy and Store Bitcoin:

Now that we've explored the potential of Bitcoin as an inflation hedge, let's discuss how you can buy and store Bitcoin securely. There are several ways to get started:

Cryptocurrency Exchanges: Cryptocurrency exchanges are online platforms where you can buy, sell, and trade Bitcoin and other cryptocurrencies. These exchanges typically require you to create an account, provide identification documents, and link a bank account or credit card for purchasing Bitcoin. Examples of popular exchanges include Coinbase, Binance, and Kraken.

Bitcoin ATMs: Bitcoin ATMs are physical machines that allow you to buy Bitcoin using cash or debit cards. These ATMs are connected to cryptocurrency exchanges and provide a convenient way to acquire Bitcoin instantly. Simply locate a Bitcoin ATM near you, follow the instructions on the screen, and complete the purchase.

Peer-to-Peer Trading: Peer-to-peer trading platforms connect buyers and sellers directly, allowing you to purchase Bitcoin from individuals rather than through an exchange. These platforms provide more privacy and flexibility in terms of payment methods. LocalBitcoins and Paxful are examples of peer-to-peer trading platforms.

Once you have purchased Bitcoin, it's crucial to store it securely. Here are a few storage options:

Hardware Wallets: Hardware wallets are physical devices specifically designed to store cryptocurrencies securely. They generate and store your private keys offline, protecting them from online threats. Popular hardware wallet brands include Ledger, Trezor, and KeepKey. These wallets provide an extra layer of security and are highly recommended for long-term storage of Bitcoin.

Software Wallets: Software wallets are applications that you can install on your computer or mobile device to store your Bitcoin. They offer convenience and easy access to your funds but may be more susceptible to hacking or malware attacks. It's essential to choose a reputable and secure software wallet such as Exodus, Electrum, or Trust Wallet.

Paper Wallets: A paper wallet is a physical copy of your Bitcoin wallet's public and private keys printed on paper. It provides an offline storage solution that is resistant to online threats. However, it's crucial to generate and print the paper wallet securely and store it in a safe place to prevent loss or theft.

Remember, regardless of the storage method you choose, it's important to backup your wallet and keep your private keys secure. Losing access to your private keys can result in permanent loss of your Bitcoin.

Incorporating Bitcoin into Your Financial Strategy:

Now that you understand the potential of Bitcoin as an inflation hedge and how to buy and store it, let's discuss how you can incorporate it into your financial strategy. Here are a few considerations:

Diversification: Bitcoin offers an opportunity to diversify your investment portfolio. By including Bitcoin alongside traditional assets such as stocks, bonds, and real estate, you can potentially reduce risk and increase potential returns. However, it's important to assess your risk tolerance and allocate an appropriate portion of your portfolio to Bitcoin.

Long-Term Investment: Investing in Bitcoin can be seen as a long-term strategy to preserve and accumulate wealth. Its limited supply and potential for growth make it an attractive option for those seeking long-term investment opportunities. However, it's important to keep in mind the volatility and perform thorough research before making any investment decisions.

Staying Informed: The world of cryptocurrencies, including Bitcoin, is dynamic and constantly evolving. It's crucial to stay informed about the latest developments, regulatory changes, and market trends. Follow reputable news sources, join online communities, and consider consulting with financial professionals to make well-informed decisions.

In conclusion, Bitcoin has emerged as a potential inflation hedge, offering unique properties and benefits that make it an intriguing asset class. While its future is uncertain and there are risks involved, Bitcoin's limited supply, decentralized nature, and growing acceptance position it as a viable option for individuals looking to protect their wealth in a turbulent economy.

By understanding the concept of inflation, comparing Bitcoin to traditional hedges like gold and real estate, and taking the necessary steps to buy and store Bitcoin securely, you can explore the potential of this digital currency and its role in your financial strategy. Remember to approach Bitcoin investment with caution, conduct thorough research, and seek professional advice when needed. The world of Bitcoin is filled with possibilities, and by staying curious and informed, you can navigate this exciting landscape with confidence.

If you want to learn more about inflation and how Bitcoin fits into the mix, please subscribe, as we will be talking about that in the near future. In the meantime, you’re welcome to read related posts on Trading Meditations Substack.

AI Meditations is the result of Artificial Intelligence (AI) reimagining and presenting the content posted on ZZ Meditations and Trading Meditations (and others), in a different way. AI is instructed to make its writing short, clear, and easy to understand, for readers and algorithms alike. We try to interfere with its work as little as possible. Sometimes that leads to some interesting results. We also encourage AI to expand on the topic and add additional value for the reader. We hope you enjoyed it.

The majority of our content is and will always remain free. If you would like to support our work, we welcome your contribution. Here are a few ways you can support us:

Engage with our content: Like, comment, and share our articles to spread the message.

Subscribe to our newsletter: Stay updated with the latest insights on AI, philosophy, perspectives, mental health, and inner peace.

Donate: If you believe in our mission, consider making a contribution.

Bitcoin wallet: bc1qc60qsgtwzhgv3nnxvx6jlsuxh2zh55x3s4fv7w