Exploring Inflation: From Hyperinflation Tales to Protecting Your Wealth

Understanding Inflation and Its Impact on Everyone

Inflation is a term that often finds its way into our conversations, news headlines, and economic discussions. But what exactly is inflation, and why does it matter to each one of us? In this essay, we will explore the concept of inflation, its causes, and its significance in our daily lives.

Defining Inflation:

At its core, inflation refers to the sustained increase in the general price level of goods and services in an economy over time. Put simply, it means that as time goes by, the cost of living tends to rise. This upward trend in prices erodes the purchasing power of money, requiring more currency to purchase the same goods and services.

Imagine a world where the cost of your morning cup of coffee skyrocketed by thousands of percent within a matter of months. Or a time when prices doubled every few hours, rendering your hard-earned money worthless. These scenarios may sound far-fetched, but history has witnessed some truly staggering episodes of inflation.

Major causes of inflation

Experts point to several prominent causes of inflation. While the exact causes can vary depending on the economic context, here are some of the commonly cited factors:

Monetary Factors: Changes in the money supply and monetary policy can significantly impact inflation. When the money supply grows faster than the rate of economic growth, it can lead to excess liquidity and increased demand, resulting in inflationary pressures.

Demand-Pull Inflation: This type of inflation occurs when aggregate demand surpasses the available supply of goods and services. Factors that can contribute to demand-pull inflation include increased consumer spending, government expenditure, investment, or exports.

Cost-Push Inflation: Inflation can also result from increased production costs, such as rising wages, higher raw material prices, or increased taxes. When businesses face higher costs, they may pass on these expenses to consumers in the form of higher prices, leading to inflation.

Expectations and Adaptive Inflation: Expectations play a crucial role in shaping inflation. If individuals and businesses anticipate future price increases, they may adjust their behavior by demanding higher wages or charging higher prices, leading to a self-perpetuating cycle of inflation.

External Factors: Economic events on a global scale, such as changes in exchange rates, international commodity prices, or trade imbalances, can influence inflation. For example, a depreciation in the local currency can increase the cost of imported goods and contribute to inflation.

Structural Factors: Long-term structural issues in the economy, such as inadequate infrastructure, supply chain bottlenecks, regulatory constraints, or market monopolies, can hinder the efficient allocation of resources and lead to inflationary pressures.

It's important to note that inflation is a complex phenomenon influenced by multiple factors, and its causes can vary across different time periods and economies.

Inflation Through History:

In the United States, Europe, and Japan, average inflation rates have fluctuated over the years, shaping the economic landscape. For example, the U.S. experienced its highest inflation rate in 1980, reaching a staggering 13.55%. In contrast, the Eurozone's highest inflation rate of 4.19% occurred in 2008, while Japan faced a peak of 24.90% in 1974. These numbers demonstrate how inflation can vary across different economies and time periods.

United States:

Average Inflation Rate (1914-2021): 3.23%

Highest Inflation Rate (Year): 13.55% (1980)

Lowest Inflation Rate (Year): -9.64% (1921)

Europe (Eurozone):

Average Inflation Rate (1999-2021): 1.66%

Highest Inflation Rate (Year): 4.19% (2008)

Lowest Inflation Rate (Year): 0.38% (2014)

Japan:

Average Inflation Rate (1958-2021): 2.12%

Highest Inflation Rate (Year): 24.90% (1974)

Lowest Inflation Rate (Year): -1.18% (2009)

But some countries have experienced extreme cases of hyperinflation, causing economic turmoil and devastation.

Zimbabwe (2007-2009):

Inflation Rate (2008): 89.7 sextillion percent (estimated)

Hyperinflation led to a collapse of the currency and severe economic turmoil.

Venezuela (2016-present):

Inflation Rate (2019): 9,585.5%

Venezuela has been experiencing hyperinflation, leading to significant socioeconomic challenges.

Weimar Republic, Germany (1921-1924):

Inflation Rate (1923): 29,500%

Extreme hyperinflation rendered the German mark worthless, causing social and political instability.

Yugoslavia (1992-1994):

Inflation Rate (1993): 313,000,000%

Hyperinflation resulted from political and economic instability following the breakup of Yugoslavia.

Hungary (1945-1946):

Inflation Rate (1946): 41.9 quadrillion percent (estimated)

Hyperinflation devastated the Hungarian economy after World War II.

Current Worldwide Inflationary Data:

The inflation rates around the world for 2022/2023 are as follows:

The global average expected inflation rate for 2023 is 7 percent, according to an economic experts survey.

The IMF forecasts a 6.6% inflation rate for 2023 and a 4.3% rate for 2024 based on their most recent update.

In January 2023, the UK's inflation rate was 10.1%, while the US's inflation rate peaked in June 2022 at 9.1% and has since slowed in each subsequent month.

Below is the list of 20 countries with the highest inflation:

Venezuela - 200.91%, 399.98%

Zimbabwe - 193.4%, 172.17%

Sudan - 340.0%

Lebanon - 201.0%

Syria - 139.0%

Suriname - 63.3%

Argentina - 51.2%

Turkey - 36.1%, 57.7%

Iran - 35.2%

Ethiopia - 33.0%

Sierra Leone - 30.0%

Haiti - 31.23%

Ghana - 29.45%

Angola - 28.0%

Nigeria - 27.0%

Malawi - 26.0%

Yemen - 25.0%

Moldova - 24.0%

Ukraine - 22.0%

Lithuania - 20.0%

Inflation's Real-Life Consequences:

Now that we understand the historical context and potential inflation hedges, let's explore the real-life consequences of persistently high inflation rates. Here are some key impacts that individuals, businesses, and economies may face:

Reduced Purchasing Power: Inflation erodes the value of money, making goods and services more expensive. This reduces the purchasing power of individuals, potentially lowering their standard of living and creating financial strain.

Uncertainty and Financial Planning Challenges: High inflation creates an environment of uncertainty, making it challenging for businesses and individuals to plan for the future. Rapid price increases can make it difficult for businesses to accurately forecast costs and set prices, leading to profit margin squeezes. Individuals may struggle to plan for long-term expenses, such as retirement or education, as the value of money diminishes over time.

Income Redistribution: Inflation can impact income distribution within a society. Fixed-income earners, such as retirees or those on fixed salaries, may struggle to keep up with rising prices, while individuals with variable incomes or the ability to negotiate wage increases may fare better. This can widen the wealth gap and create social inequalities.

Impact on Investments: Inflation can affect investment returns and asset values. Bonds and fixed-income investments may experience reduced purchasing power, leading to negative real returns. However, certain assets like stocks, real estate, and commodities have the potential to outpace inflation and provide positive returns.

International Competitiveness: Inflation can impact a country's international competitiveness. If prices rise significantly in one country, its exports may become more expensive, leading to decreased demand and a loss of market share. This can harm industries reliant on international trade and hinder economic growth.

Central Bank Actions: In response to high inflation, central banks may implement monetary policy measures, such as raising interest rates or reducing money supply, to curb inflationary pressures. These actions can have broader economic implications, influencing borrowing costs, investment decisions, and overall economic stability.

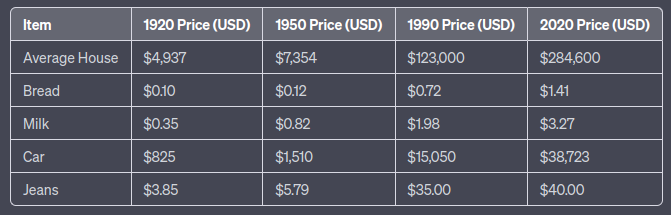

Here is a table showing the approximate prices of various items in the USA in the years 1920, 1950, 1990, and 2020:

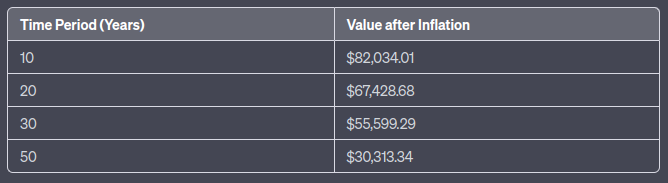

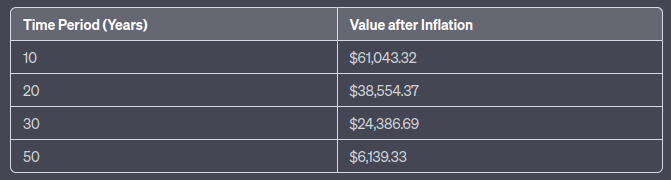

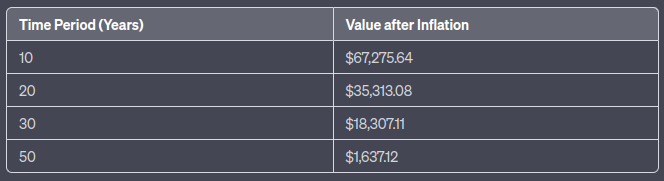

Here's a table showing how $100,000 USD would lose its real value over different periods of time with inflation rates of 2%, 5%, and 10%:

Inflation Rate: 2%

Inflation Rate: 5%

Inflation Rate: 10%

Please note that these values are approximate and represent the erosion of purchasing power due to inflation.

Preserving Wealth in an Inflationary World:

In times of inflation, individuals seek ways to protect their wealth from eroding purchasing power. Historically, several assets have been considered potential hedges against inflation. Let's explore a few popular options and their historical performance:

Gold: Over the past century, gold has been an effective inflation hedge, providing average annual returns of approximately 4.9% to 9.0%. Its enduring value and limited supply have made it a popular choice for investors seeking to preserve their wealth.

Real Estate: Residential and commercial properties have historically been reliable inflation hedges, with returns varying based on location and market conditions. Real estate has provided attractive returns, especially in growing markets, offering individuals a tangible asset to safeguard against inflation.

Treasury Inflation-Protected Securities (TIPS): These U.S. government bonds are specifically designed to protect against inflation. TIPS provide returns closely tied to inflation rates, preserving the purchasing power of your investments.

Stocks: Equities have been a popular choice for investors seeking long-term inflation protection. While stock market performance can be volatile, historically, stocks have generally outperformed inflation, making them an appealing option for those willing to weather short-term fluctuations.

By diversifying their portfolios across these assets, individuals can mitigate the impact of inflation and potentially preserve their wealth over time. However, it's crucial to conduct thorough research and consult with financial advisors before making any investment decisions.

Conclusion:

Inflation, particularly when it reaches extreme levels, can have profound and far-reaching consequences for individuals, businesses, and economies. Understanding the causes and historical examples of inflation provides valuable insights into potential future scenarios. By diversifying investments and exploring assets with inflation-hedging properties, individuals can better protect their wealth from the erosive effects of inflation. Moreover, governments and policymakers play a crucial role in implementing effective monetary policies to maintain stable prices and mitigate the negative impacts of inflation.

If you want to learn more about inflation and how Bitcoin fits into the mix, please subscribe, as we will be talking about that in the near future. In the meantime, you’re welcome to read related posts on Trading Meditations Substack.

AI Meditations is the result of Artificial Intelligence (AI) reimagining and presenting the content posted on ZZ Meditations and Trading Meditations (and others), in a different way. AI is instructed to make its writing short, clear, and easy to understand, for readers and algorithms alike. We try to interfere with its work as little as possible. Sometimes that leads to some interesting results. We also encourage AI to expand on the topic and add additional value for the reader. We hope you enjoyed it.

The majority of our content is and will always remain free. If you would like to support our work, we welcome your contribution. Here are a few ways you can support us:

Engage with our content: Like, comment, and share our articles to spread the message.

Subscribe to our newsletter: Stay updated with the latest insights on AI, philosophy, perspectives, mental health, and inner peace.

Donate: If you believe in our mission, consider making a contribution.

Bitcoin wallet: bc1qc60qsgtwzhgv3nnxvx6jlsuxh2zh55x3s4fv7w